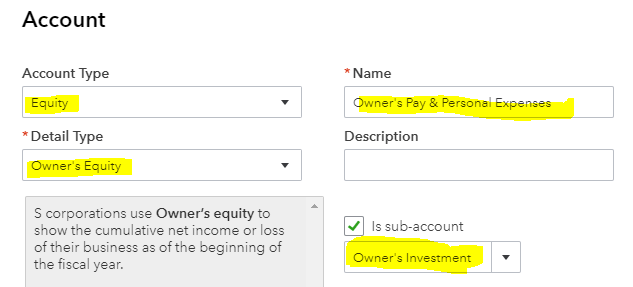

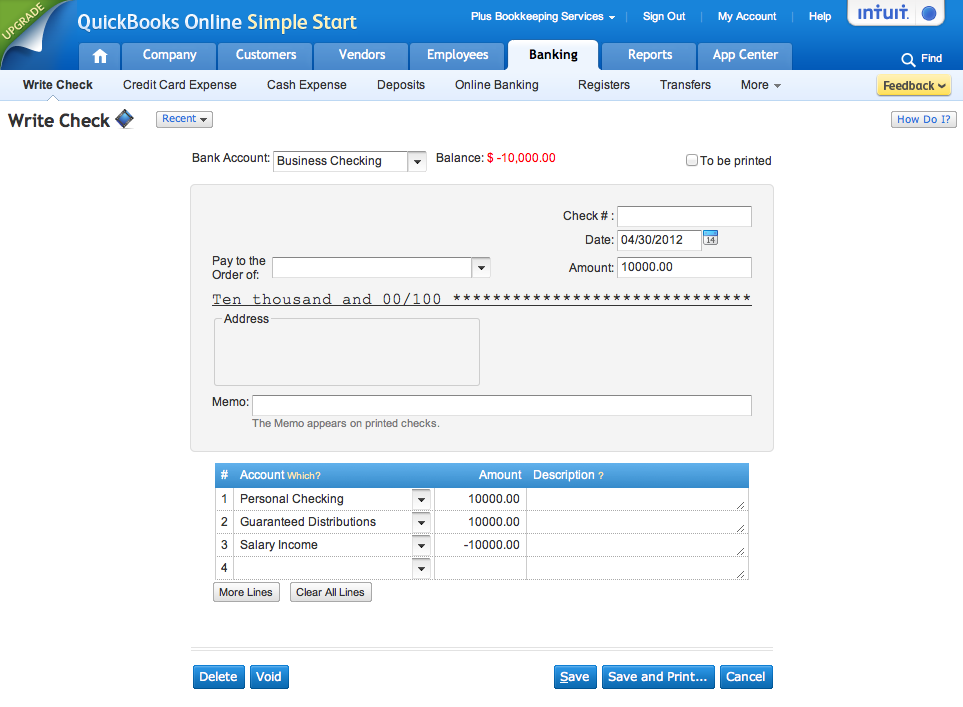

One exception to note is how business credit cards transactions are recorded. With an accrual accounting method all expenses for the period show up on your Profit and Loss Report, regardless of whether they have been paid. With a cash accounting method only paid expenses for the period show up on your Profit and Loss Report. Share Business Growth Trend Insights with Your Business Partners and Investors This is strong reason for businesses to use the cash method over the accrual method of accounting. With the accrual accounting method, you pay the State Taxes due for products and services sold during the reporting period regardless of whether payment has been received. With the cash accounting method, you pay State B&O Sales and Use Taxes due for products and services sold during the reporting period only if payment has been received. Each type of report has its value in terms of your Budgeted versus your Actual Business Revenues and Expenses. To understand your accounting story, you can create a custom Management Financial Report suite in QuickBooks Online that includes both cash and accrual financial reports. When you run income reports on an accrual basis you can review what you have earned but not yet received, and when you run balance sheet reports on an accrual basis you can review the outstanding liabilities that have been recorded but not yet paid. You have the option to run your financial reports in QuickBooks Online on either an accrual basis or a cash basis. Running Your Financial Reports on a Cash and an Accrual Basis Using the cash accounting method can help business owners with cash flow management. This means that they record income when it is received, and they record expenses when they are paid. Many small businesses use the cash accounting method. In recent years, the amount of money a business can make before going to an accrual method of accounting was significantly increased. Small business owners often use cash accounting methods and run a variety of financial reports in QuickBooks Online that are tailored to their individual business needs. PART 2 – CREATE CUSTOM MANAGEMENT FINANCIAL REPORTS You can create custom reports for each of these accounts that give you the best insights on how much money you have personally put-in and taken-out of your business profits over time. By doing this, you keep a running Balance Sheet total between the two accounts, and you have a separate register for each account that you can reconcile and run reports on. You create two equity accounts, a master account named Owner’s Investment and a sub-account to this master account named Owner’s Pay & Personal Expenses.

Two frequent questions that smart business owners frequently ask their accountants are: Recording Owner’s Personal Contributions and Personal Expenses

If you do, let your accountant know right away so that can correctly categorize the personal expenses charged to your business account in accordance with the IRS tax rules. This is quite alright to do folks, just don’t co-mingle personal and business expenses in the same account.

It is not uncommon for small business owners to connect a personal checking or credit card accounts to QuickBooks Online.

0 kommentar(er)

0 kommentar(er)